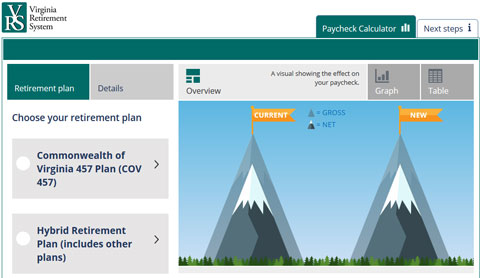

Deferred compensation plan calculator

Both qualified and nonqualified plans are funded with tax. Out of every 100 you make Assumes state and federal income taxes of 25.

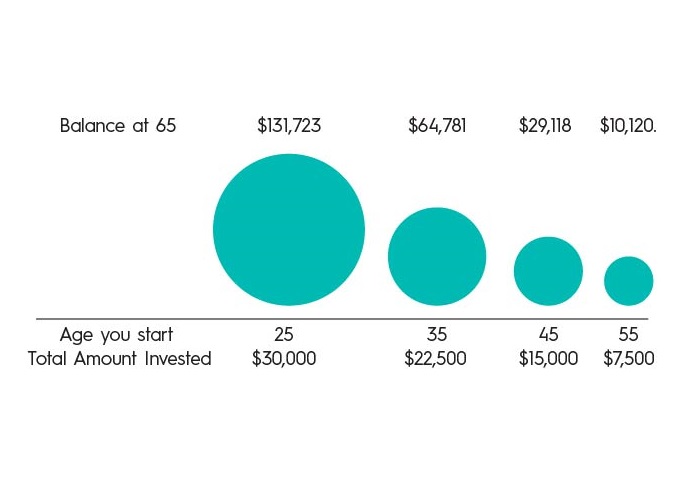

Future Value Calculator

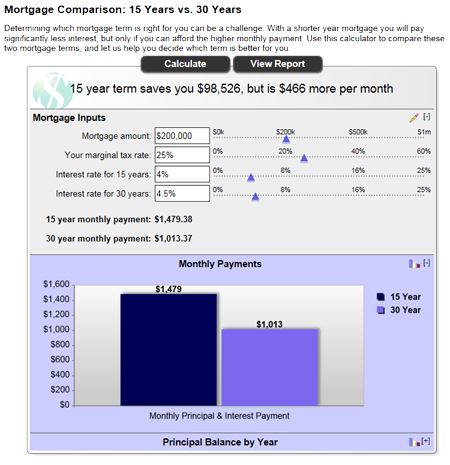

Annual contribution limits Your total contribution for one year is based on your annual salary times the percent you.

. Build Your Future With a Firm that has 85 Years of Investment Experience. Plans of deferred compensation described in IRC section 457 are available for certain state and local governments and non-governmental entities tax exempt under IRC Section 501. How much can I withdraw.

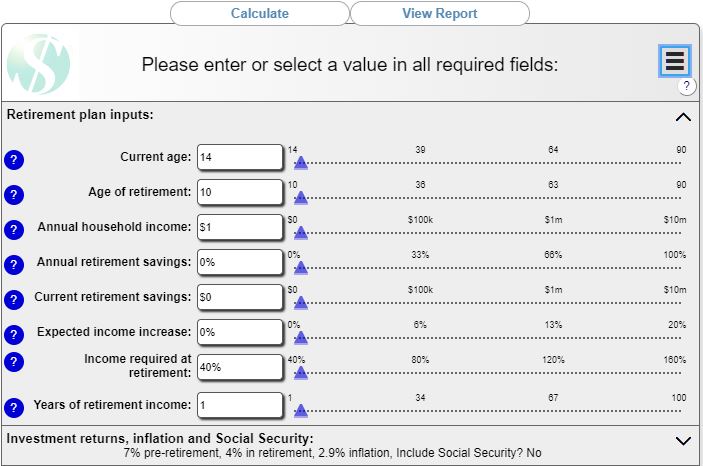

Build Your Future With a Firm that has 85 Years of Investment Experience. In general you can retire as early as age 50 with five years of service credit unless all service was earned on or after January 1. MO Deferred Comp Calculators These calculators are for informational use only.

Once youve logged in to your account you will find even more tools that can help you. To learn more about the Accrued Leave Deferral Option or to enroll please feel free to call us. Ad Whatever Your Investing Goals Are We Have the Tools to Get You Started.

Types of Deferred Compensation Plans. Ad Calculate and Compare a Normal Taxable Investment to Two Common Tax Advantaged Situations. If you have questions about Americans with Disabilities Act Standards for Accessible.

Ad Help Ensure You Wont Run Out of Money In Retirement with Our Free Guidebook. How long will my money last. Outdated or Unsupported Browser.

The Minnesota Deferred Compensation Plan MNDCP is a voluntary savings plan intended for long-term investing for retirement. It not only takes into account your annual contributions projected return on. Service retirement is a lifetime benefit.

Broadly speaking deferred compensation refers to any and all compensation plans that allow you to postpone a portion of your income to the future reducing your current. This calculator limits your contribution to 50 of your salary. Learn what type of.

The Better Way To Manage All Types Of Compensation. You are using an outdated or unsupported browser that will prevent you from accessing and navigating all of the features of our. Ad Bring order and efficiency to salary administration processes with our software.

There are two paycheck calculators that compute paychecks for employees in Illinois and New York. RetiremenTrack This calculator uses your personal information to develop a custom savings. The State of Illinois Deferred Compensation Plan Plan is a supplemental retirement program for State employees.

Ad Whatever Your Investing Goals Are We Have the Tools to Get You Started. The New York State Deferred Compensation Plan is a State-sponsored employee benefit for State employees and employees of participating employers. Here are some tools and calculators that may help you get a better idea about what you will need.

The New York City Deferred Compensation Plan DCP allows eligible New York City employees a way to save for retirement through convenient payroll deductions. The executive deferred compensation plans can be geared to certain classifications of employees. This calculator helps illustrate what it might take to eventually reach your objectives.

Select your monthly DCP contribution 30 to 500 550 to 1050 1100 to 2000. Spring Street Room 867 is closed. Tackle 11 Potential Retirement Issues Before its Too Late Get Your Guide Now.

Investor Type What type of investor are you. This 457 Savings Calculator is designed to help you make that prediction as accurately as possible. Retirement savings plans like 401ks 403bs and IRAs are considered qualified deferred compensation plans.

Free Calculator to Help Compare Taxable Investment to 2 Common Tax Advantaged Situations. Distributions from a tax-deferred plan will be taxed as ordinary income when distributed. Currently our Plan Service Center located at City Hall 200 N.

DCP Calculator How much can I save. Contributions to the Plan can be made on a pre-tax or Roth. Here are some of the disadvantages of the executive deferred.

Authorized under Section 457 of the. The Maryland Deferred Compensation Program was established for Maryland state employees in 1974 by Executive.

403 B Vs 457 B What S The Difference Smartasset

Calculators Planmember Retirement Solutions

913 457 Images Stock Photos Vectors Shutterstock

Vrs Contributions

Financial Calculators Service2client S Website Tools

Mpsers Employer News May 2022

457 Deferred Compensation Plan

Financial Calculators Lally Co

Financial Calculators

Compound Interest Calculator Daily Monthly Quarterly Annual

Retirement Calculator Sams Investment Strategies

Net Income Calculator Sale 56 Off Www Wtashows Com

Retirement Income Calculator Faq

Looking For Secure Retirement A 457 Plan Could Be The Best Tool For Creating A Secure Retirement Use Our 457 Retirement P How To Plan Finance Blog Retirement

Retirement Planner

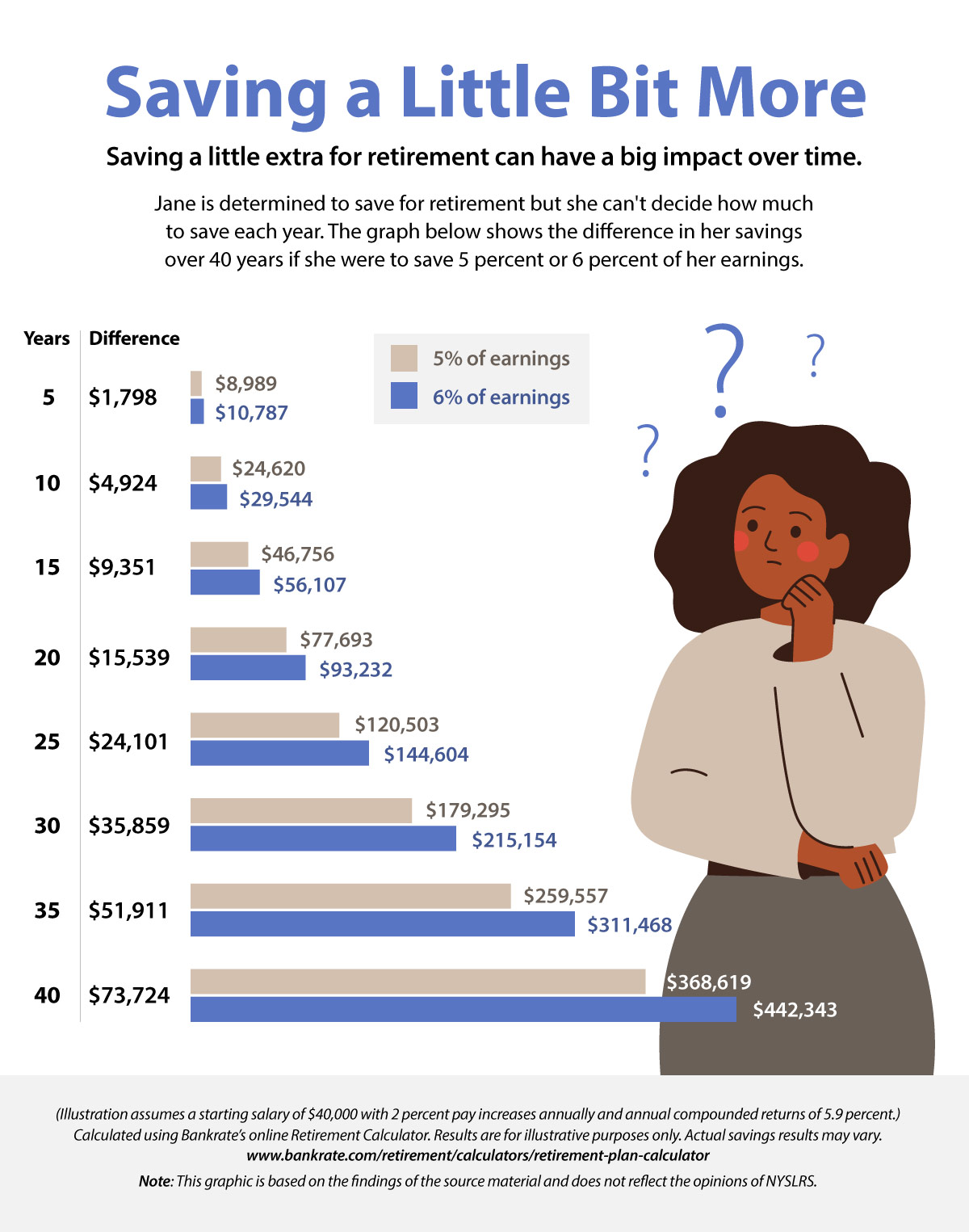

Give Your Retirement Savings A Boost New York Retirement News

913 457 Images Stock Photos Vectors Shutterstock