Profit margin per product

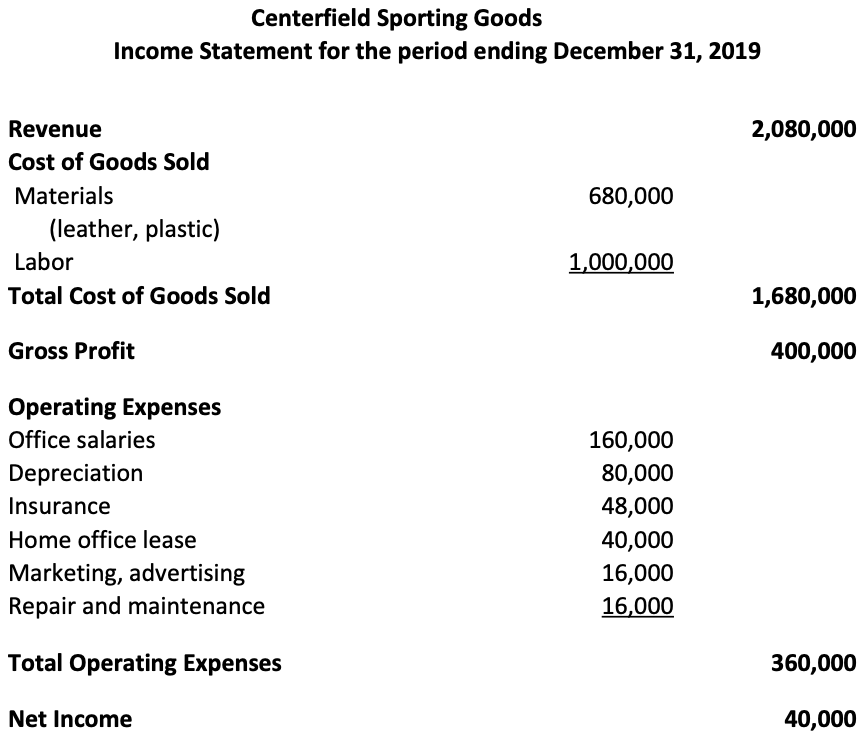

Gross margin return on investment GMROI Your retail stores gross margin return on investment or GMROI refers to your inventorys profitability. The gross profit margin can be used by management on a per-unit or per-product basis to identify successful vs.

How To Price Your Products In 3 Simple Steps 2022

The operating profit margin is useful to identify the.

:max_bytes(150000):strip_icc()/dotdash_Final_Profit_Margin_Aug_2020-01-853bda68168747d89807dc6ad1053843.jpg)

. It acts as a measure for the amount of net income or net profit a business makes per dollar or pound of revenue earned. Its easy to add new products to your Shopify store and when it comes to measuring the profitability on a per-product or overall basis you can install a profit margin calculator Shopify app such as BeProfit Profit Tracker. Therefore it is not advised to continue selling your product if your contribution margin ratio is too low or negative.

True profit after all costs and expenses are accounted for. Ad Being an Industry Leader is Earned Not Given Business Planning Simplified. Gross profit margin shows how efficiently a company is running.

If you sell a product for 50 and it costs you 35 to make your gross profit margin is 30 15 divided by 50. Company Fixed a particular margin like 5 10 20 30 etc and dispatch to. At roughly 15 percent cigarettes had the lowest margin.

ABC is currently achieving a 65 percent gross profit in her furniture business. Practically all these expenses cost could not been added in any single product but expenses calculation verses profit margin is based upon all products included in companys product list. Definition Product margin is the profit margin per product.

For example say Chelsea sells a cup of. Those direct costs are also called cost of. While the average profit margin for online retail is 45 the exact margin varies from product niche to product.

Profit margin and markup are like two sides of the same coin. But Store B could have higher overhead costs or pay its employees 2 more per hour than Store A. This calculates the profit margins for your inventory ie how much money your inventory has made you.

Similar to food trucks catering businesses benefit from low overhead costs but similar food costs when compared with an FSR. How to improve restaurant profit margins. That is the difference between per unit selling price and the per unit variable cost of your product.

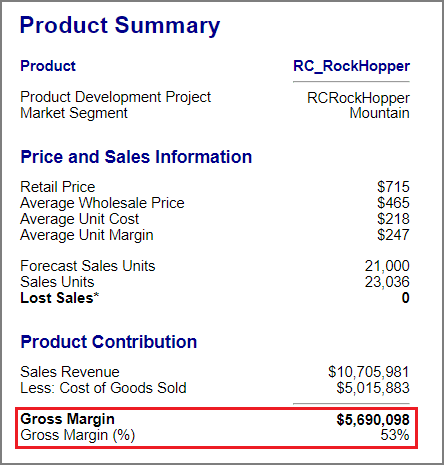

For example if Store A and Store B have the same sales but Store As gross margin is 50 percent and Store Bs gross margin is 55 percent which is the better store. This is because it. Gross margin is expressed as a percentageGenerally it is calculated as the selling price of an item less the cost of goods sold e.

While this is very similar to net profit sales margin is in per unit terms. In other terms product margin is used to determine how much of the products selling fee is a markup. Gross margin shows the revenue a company has left over after paying all the direct expenses of manufacturing a product or providing a service.

In regard to efficiency with inventory Store B is the winner. Subtract 02 from 1 to get 08. Contribution Margin Per Unit is the profit that remains on selling the single unit of your product.

Over a decade of business plan writing experience spanning over 400 industries. While a high-end catering business can pull in profits of 15 or more the overall average profit margin for a food truck is 7-8. Your sales margin is the product of the selling price an item or service.

In cost-volume-profit analysis a form of management accounting contribution marginthe marginal profit per unit saleis a useful quantity in carrying out various calculations and can be used as a measure of operating leverageTypically low contribution margins are prevalent in the labor-intensive service sector while high contribution margins are prevalent in the capital. For a company that produces varied products calculating the product margins of the various. If a products contribution margin is negative the company is losing money.

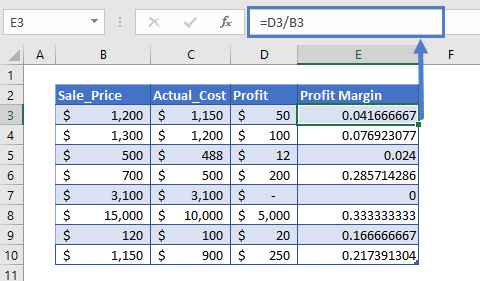

A business with strong total sales could seem healthy on the surface but might actually suffer losses if high operating expenses arent considered. It is determined by subtracting the cost it takes to produce a good from the total revenue that is made. How do I calculate a 20 profit margin.

Gross Profit Average Inventory Cost. How to calculate net profit margin. Guidance implied fiscal 2023 earnings per share of 325 to 4.

Generally gross profit margin is a better way to understand the profitability of specific items rather than an entire business. At over 50 percent health and beauty care products had the highest gross profit margin in convenience stores in the United States in 2017. The product margin shows the amount the product sells for above the cost of manufacturing the product.

Many leaders look at profit margin which measures the total amount by which revenue from sales exceeds costs. Nike stock dives as Wall Street jeers margin outlook rather than cheering profit and revenue beats. Target profit fixed costs contribution margin per unit projected sales 140000 14000 19 8105.

Catering profit margins. In Generic Marketing Type company dont spend at sales team doctors etc. Freight and product costs.

Markup is calculated on a per-product basis. Production or acquisition costs not including indirect fixed costs like office expenses rent or administrative costs then divided by the same selling. 2018-2019 Monthly retail store sales worldwide as of 2018.

Bountiful Blankets needs to sell 8105 blankets during the third quarter in order to meet their target profit goal of. Gross profit margin of retail companies in China 2010-2013 by origin Number of store openings and closures of major retailers in the US. Gross profit margin gross profit revenue x 100.

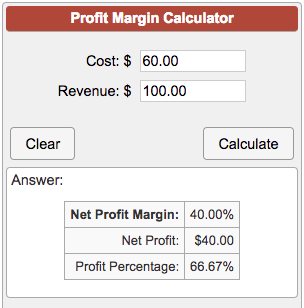

Net profit margin measures the profitability of a company by taking the amount from the gross profit margin and subtracting other operating expenses. Use this calculator to work out your gross margin sales margin or net profit margin for your product or business Quick Search. Gross margin is a good figure to know but probably one to ignore when evaluating.

Express 20 in its decimal form 02. Gross Profit Margin can be calculated by using Gross Profit Margin Formula as follows Gross Profit Margin Formula Net Sales-Cost of Raw Materials Net Sales Gross Profit Margin 100000- 35000 100000 Gross Profit Margin 65. They apply the CVP analysis formula.

Divide the original price of your good by 08. Gross margin is the difference between revenue and cost of goods sold COGS divided by revenue.

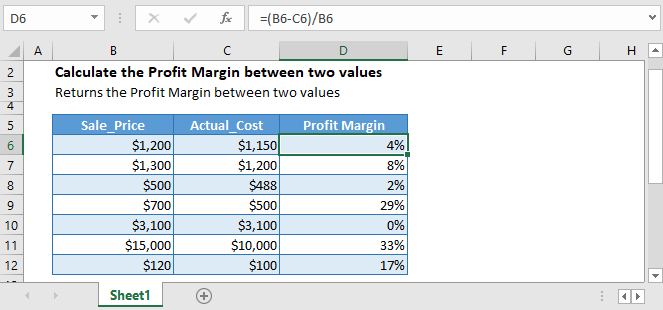

Profit Margin Formula And Ratio Calculator Excel Template

Gross Profit Margin Formula And Calculator Excel Template

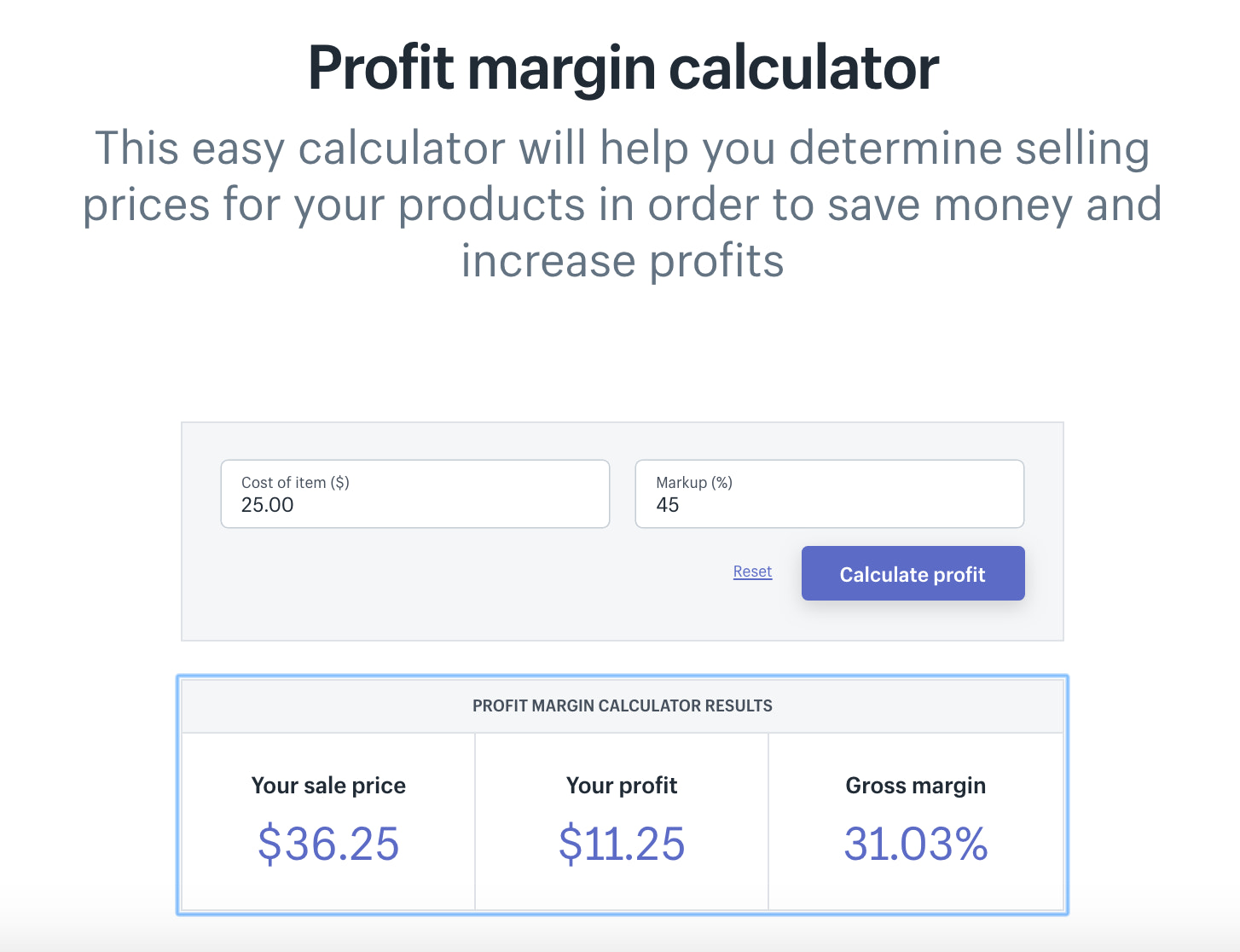

Margin Calculator

/dotdash_Final_Gross_Margin_vs_Net_Margin_Whats_the_Difference_Nov_2020-01-de889f0261d2482780bda560dc14a6ce.jpg)

How Does Gross Margin And Net Margin Differ

6 Ways To Increase Profit Margin For Ecommerce Businesses 2022

:max_bytes(150000):strip_icc()/dotdash_Final_Profit_Margin_Aug_2020-01-853bda68168747d89807dc6ad1053843.jpg)

Profit Margin Defined How To Calculate And Compare

What Is Gross Margin And How To Calculate It Article

How Do I Calculate Gross Margin Smartsims Support Center

Profit Margin Calculator In Excel Google Sheets Automate Excel

Gross Profit Margin Vs Net Profit Margin Formula

Profit Margin Calculator In Excel Google Sheets Automate Excel

:max_bytes(150000):strip_icc()/dotdash_Final_How_Do_Gross_Profit_and_Gross_Margin_Differ_Sep_2020-01-441a7bebdebb492a8ac3a1e3ea890ab9.jpg)

How Do Gross Profit And Gross Margin Differ

/dotdash_Final_How_Do_Gross_Profit_and_Gross_Margin_Differ_Sep_2020-01-441a7bebdebb492a8ac3a1e3ea890ab9.jpg)

How Do Gross Profit And Gross Margin Differ

What Is The Gross Profit Margin Bdc Ca

Profit Margin Calculator

Net Profit Margin Calculator Bdc Ca

Net Profit Margin Calculator Bdc Ca